Security is Critical to Fintech Businesses

The growing demand for digitalization in the financial services industry has led to the steady growth of fintech services. Fintech services provide specialized software solutions to end users which can be accessed on smartphones and computers. But, with great demand comes great cyber security risks!

Cyber-Attacks are Inevitable

The use of finance-related technologies poses cyber security threats. Currently, the number and type of cyberattacks are increasing at an alarming rate. According to the BCG report, the probability of finance industries getting cyber attacked is 300 times than that of other sectors to be targeted for a cyberattack. Dealing with such kinds of attacks is critical and fintech businesses must ensure to have a defense firewall in place to keep the attackers at bay. Cyber-attacks are inevitable and are bound to happen. What’s important for fintech startups and businesses is to stay alert and prepared with threat intelligence solutions.

To mitigate the cyber security risks, you have to get to know them first.

Types of Cyber Security Risks to Fintech:

1. Cross-platform malware:

Fintech companies use several digital platforms for different purposes which includes cloud services from a specific vendor and website essentials from another vendor. Therefore, the hackers would develop the malware to infect the finance services from one platform, and then they would propagate the malware from another platform. This is known as cross-platform malware infection. Moreover, not every financial service provider uses the same level of cyber security and compliance model. Still, some vendors use traditional and outdated technologies and other segments of vendors that use modern and reliable technologies. The biggest problem with the use of traditional and outdated technologies is not only cybersecurity risks but also huge compatibility issues.

Therefore, finance service providers should not encourage business’ reliability on multiple vendors. Thus, the only one-stop solution should be to protect data, backup data to other remote places/ cloud, recover data instantly in case of disasters. Lastly, the technology should also be compatible with several technologies and systems to access.

2.Identity Theft:

To ensure secure, digital transactions and to authenticate the identity of the user, most financial institutions use passwords, one-time payments, and biometrics. But, the potential drawback of this method is that it the hackers can easy replicate it and use it as an initiating point to siphon huge amounts of money. The best possible solution to mitigate the risk is to use multiple verification gateways. Furthermore, rely these different gateways on different technologies and principles to make replication even more difficult.

3. IoT Devices and mobile platforms:

Cloud services are the most used services for digital transformation, especially, in the financial and banking industry. Digital wallets, payment gateways, websites, and mobile apps use cloud services for security, speed, scalability, and for numerous other benefits. If the number of devices that have access to a specific account is more, the account has a high chances of getting hacked and broken down by cyber attackers. Additionally, voice assistants and IoT add more risk. Therefore, it is imperative for financial technology-based industries to add supporting platforms after rigorous security testing.

4. Application Breaches

FinTech applications usually rely on software that facilitates the end-users to fill in sensitive information and transfer money with a screen touch. However, these applications also serve as attack vectors to hackers as they are user-facing. Gaining access to these applications is easy than gaining access to the organization’s network directly. The hacker aims to breach the application to acquire access to information, the money gets instantly transferred, and soon the hacker gets access to the entire network (all within seconds)!

Therefore, regular vulnerability scanning and penetration testings are required for web and mobile applications.

5. Cryptocurrency and Money Laundering risks

In recent years, cryptocurrency has got lots of attention, but it has also posed major security challenge for finance technologies. Cryptocurrency could be an easy way to launder money because the origin of money anonymous, mostly. For data theft, hackers use cryptocurrency transfers as entry points as they can be scammed. Such security risk can be a critical problem concerning law enforcement and financial losses. FinTech companies should access secure trading applications when handling cryptocurrencies. But most importantly, the consumers need to rely on mainstream cryptocurrencies that are recognized universally.

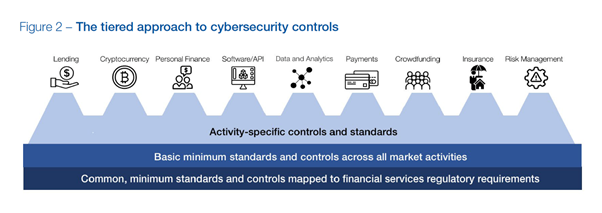

The World Economic Forum’s FinTech Cybersecurity Consortium has also revealed a standard framework to get rid of cybersecurity threats:

Enterprise should choose the best FinTech providers who follow multi-layered threat control protocols to ensure complete security and compliance for the customer.

All sector enterprises require a widely accepted and mutually understood cybersecurity controls baseline. High clarity is necessary at the base level because it provides effective protection.

Fintech Startups with Weak Cyber Security Strategies Are Easy Targets for Cyber Criminals

Cyber criminals often target startups because they grow fast and innovate quickly. Most startups in their early stages of business do not focus much on data protection and securing their infrastructure from malware and cyber-attacks. Therefore, they become viable targets and get exposed to hackers. The attackers can easily access both the financial and personal data wrapped together, putting the startup’s business at stake!

In conclusion, if you run a FinTech company, you should for sure focus on cybersecurity. Any negligence would result in huge financial loss and consumer trust. Therefore, data security solutions and cyber protection should be the primary concern for any company.

Run Routine Cyber Security Audits

Cyber threats will keep evolving and it is imperative to have security patches applied to all of your day-to-day operations. “Work From Home’ has become the new norm and is here to stay. The attackers will make more malicious attempts to hack unsecured networks of employees who are most vulnerable to cyber-attacks. Let’s stay prepared!

Call us today to run a free security audit to check your cyber security preparedness and our team will guide you on how to bullet-proof your business with Flux Networks.

Recent Comments